Supply Chain Finance

Supply chain finance has gradually evolved a variety of distinctive operating modes under the management of different operating entities.

Mode one

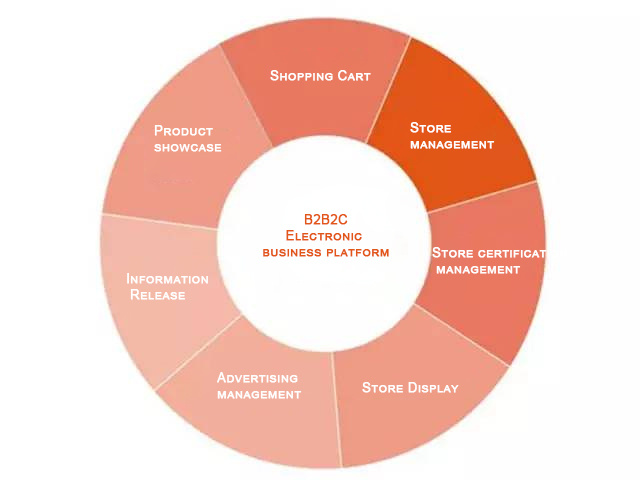

B2C e-commerce model

B2C e-commerce platforms have accumulated high-quality and accurate data such as basic information and historical information of all businesses on the platform. B2C e-commerce platforms can provide supply chain financial services to creditworthy merchants by processing these data. By using the customer's transaction flow and payment records on the platform, the risk assessment credit limit is screened and then credit loans are issued. In addition to earning financial profits from upstream and downstream suppliers in the industrial chain ecosystem, the platform also promotes the healthy development of its own ecosystem.

Mode two

Industry Information Portal Mode

The industry information portal attracts a large number of companies in the same industry chain to enter the site by providing information on specific industries or information on suppliers and traders, solving financial problems for these companies, and at the same time using its platform resources for business development And extension.

Mode Three

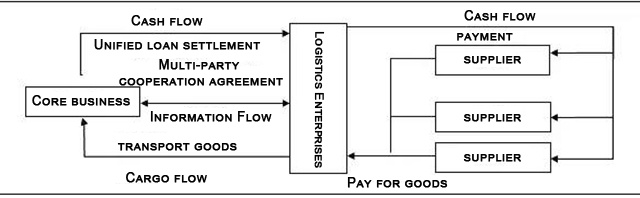

Logistics company model

In the traditional supply chain finance model, logistics companies are both participants and very important third parties. In the Internet + era, logistics companies have turned to e-commerce and extended to supply chain finance based on their long-standing relationships in the upstream and downstream of the industry. . Logistics enterprises participate in the operation of the supply chain through logistics activities. By integrating the logistics network in the supply chain, linking capital providers, providing logistics supply chain services and financing solutions for service objects is conducive to stabilizing the business network and enhancing the competition of logistics enterprises ability. With unique resources in the upstream and downstream of industrial chain logistics and distribution, if the supply chain finance of the e-commerce model is transformed, it will occupy an advantageous position.

Mode Four

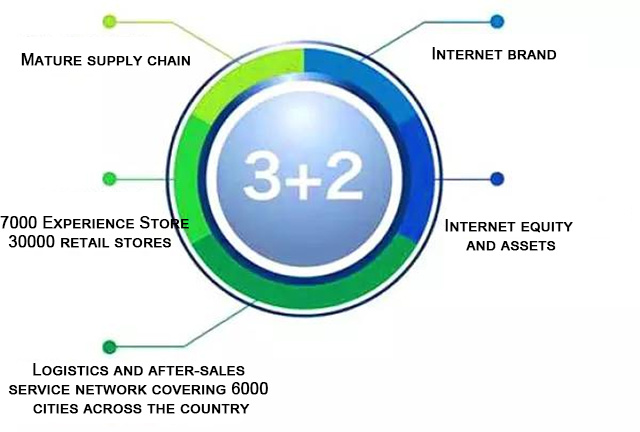

Traditional leading enterprise model

The transformation of traditional companies is not just for the oncoming "Internet +" wave impact, but also a step that must be taken in the context of China's economic transformation and the impact of corporate Internetization, and the upgrading and transformation of various industries. Listed companies can be regarded as leading companies in their respective industries. It is self-evident that they have a deep industry background, resources, and upstream and downstream relationships. It is natural to use the industry background to develop supply chain finance. Many of the entity companies of A-share listed companies have deployed supply chain finance businesses. The logic is to use the industry resources that have been operating for many years and understand the risks and conditions of the industry. From the big brother of the industry to the role of the industry's "supply chain financial service provider", it is for individuals who are difficult to obtain loans from banks or other financial institutions. Or the provision of guarantees by small, medium and micro enterprises, Internet investment and financing, etc., for listed companies, it is to establish their own closed-loop financial ecosystem; for the industry, it is to help small, medium and micro enterprises to survive.

Mode Five

Commercial Bank Model

Commercial banks can be said to be the absolute power of supply chain finance in the early years. Later, with the addition of diversified entities, their indomitable entities began to be affected. However, due to the natural advantages of commercial banks in terms of capital costs, commercial banks have It still occupies a very important position in the development of the supply chain financial industry. Commercial banks use core enterprises as the central point and from the perspective of the entire supply chain to issue credit loans to core enterprises. Through the movable assets of the upstream and downstream of the company, provide targeted credit enhancement, financing, guarantee, settlement, risk aversion and other financial product combinations and solutions for the company in the procurement of raw materials, manufacturing and merchandise sales. On the basis of supply chain finance, banks can systematically provide innovative supply chain financial products and business models according to the customer’s industry and the characteristics of the financing enterprise’s own development to meet the individual needs of different customers and provide a variety of Mode of financing solutions.

Concluding remarks

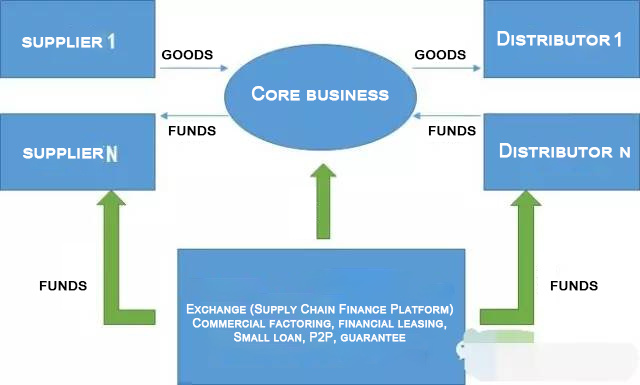

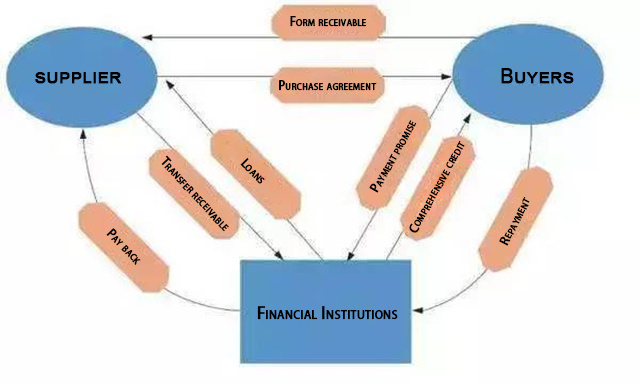

Supply chain finance refers to the use of self-compensated trade financing methods based on core customers and real trade backgrounds to close the flow of funds or control property rights through means such as pledge of accounts receivable and pledge of goods rights. Comprehensive financial products and services provided by upstream and downstream enterprises.

The essence of supply chain finance is credit financing, and credit is found in the industrial chain. In the traditional way, financial institutions use data provided by third-party logistics and warehousing companies to verify the credit of core companies and supervise the inventory and accounts receivable information of the financing group.